Wining, Dining, and Deductions: A Business Expense Breakdown

- Kayla Smith-Haynes

- Oct 10

- 4 min read

Running a business involves more than just selling a product or service—it also includes building relationships, rewarding employees, and expanding your professional network. Meals and entertainment can be part of those efforts, but the rules around what’s deductible can be tricky. Understanding how the IRS treats these expenses can help you stay compliant and reduce your tax bill without crossing any lines.

What counts as a Deductible Meal Expense?

Meal expenses are only deductible if they are directly related to the business. In general, you can deduct 50% of the cost of business meals if ALL of the following conditions are met:

The meal is with a client, customer, employee, or business associate.

There is a clear business purpose or discussion either before, during, or after the meal.

The expense is not lavish or extravagant under the circumstances.

You or an employee are present during the meal

Fully Deductible Meals

While most business meals are subject to the 50% rule, a few meal types are 100% deductible, such as:

Company holiday parties or appreciation events: These are typically open to all employees and are fully deductible as employee entertainment.

Meals provided during company retreats or training: When food is provided as part of an event with a clear business purpose, it is fully deductible.

Promotional meals for the public: Food served during open houses, workshops, or marketing events is considered a promotional expense and is also fully deductible.

What About Entertainment Expenses?

Since the 2018 tax reform (Tax Cuts and Job Act), most entertainment expenses are no longer deductible. This includes:

Sporting Events

Concerts and theater performances

Golf outings and other recreational activities

However, some related expenses might still be deductible, like meals purchased during an entertainment event (e.g., food at a sports stadium).

IRS Rules on Using Per Diem Rates Under Section 274(d) and Rev. Proc. 2019-48

If you or your employees travel for business, the IRS updates per diem rates every year to help simplify how meals, lodging, and incidental expenses are handled. Instead of saving every receipt, businesses can use these flat daily rates to reimburse employees.

Here’s what’s new for the 2025-2026 travel year, starting October 1, 2025:

Transportation Industry (Truckers, Pilots, etc.)

There are special rates for people in the transportation industry (like long-haul truck drivers), since their work takes them across different locations regularly.

o $80 per day for travel within the U.S.

o $86 per day for travel outside the U.S.

Incidental Expenses Only

If you’re not claiming meals – just minor travel fees – the incidental-only rate is a flat $5 per day, no matter where you’re traveling.

High-Low Per Diem Method

The high-low method is a simplified way to handle per diem reimbursements based on whether you’re in a high-cost or low-cost area

o High-cost areas: $319 per day (includes $86 for meals)

o All other locations: $225 per day (includes $74 for meals)

This method helps streamline bookkeeping and is commonly used by companies with regular travel needs.

A handful of U.S. cities are considered high-cost localities, meaning you can use the higher per diem rate when traveling there. The list changes slightly each year, and eligibility often depends on specific months when travel demand (and hotel rates) are highest.

Some of the key high-cost cities this year include:

There are many others — from beach towns in the summer to ski towns in the winter — so it’s worth checking the full list if you have frequent travel.

Big Changes Ahead for Employer-Provided Meals: What You Need to Know Before 2026

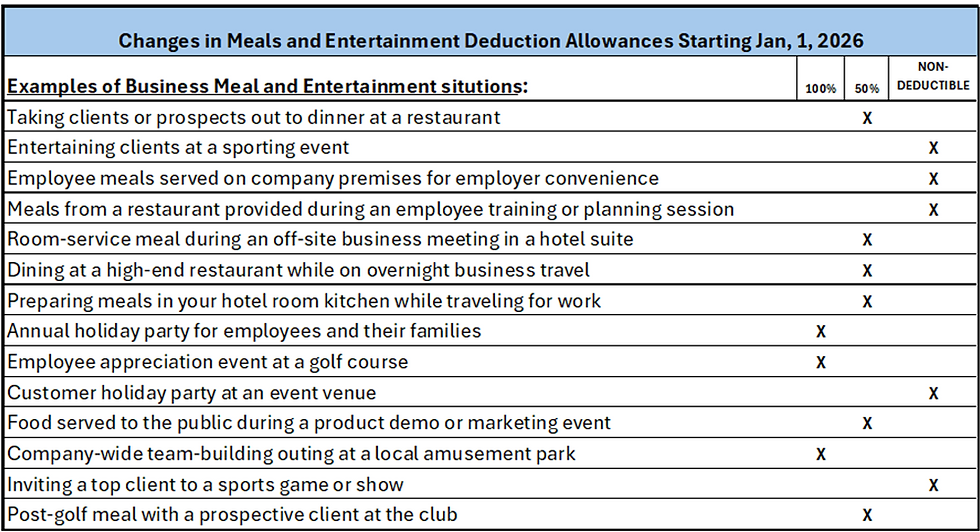

With the changes to Section 274(o) of the tax code quickly approaching (taking effect January 1, 2026) it’s time to start paying attention and updating company policies.

Thanks to the 2017 Tax Cuts and Jobs Act (TCJA), starting in 2026, employers will no longer be able to deduct any expenses for:

Meals, drinks, and snacks for the convenience of the employer

Meals in company cafeterias – whether run by the business or a third party

A takeout lunch brought into the office for a staff meeting

This full disallowance could have a significant impact on businesses that currently rely on subsidized meals as part of their workplace culture or employee benefits. Navigating the new rules requires careful planning and consideration. For example, deductions may still be allowed for:

A meal with a client at a sit-down restaurant to discuss business

Dinner for an employee traveling overnight for work

Meetings with employees at a restaurant that serve a business purpose

With these changes coming into effect for expenses paid or incurred after December 31, 2025, companies should start evaluating their current meal programs and consider whether they’ll fall under any of the new exceptions.

It’s also important to keep an eye on any additional guidance from the Treasury Department and IRS – further clarifications could shape how these rules are ultimately applied.

Tips on Staying Compliant with Tax Regulations

It is important to make sure that you are keeping track of all meals and entertainment related business expenses as they occur.

Document Everything: Always note who attended, the business purpose of the meal or meeting, and retain itemized receipts.

Separate Meal and Entertainment Charges: When attending events, ask for separate billing to ensure any meal portion remains deductible, and record 100%, 50%, and non-deductible expenses in separate ledger accounts on the books.

Avoid Lavish Expenses: Keep meals reasonable and aligned with your industry norms. Lavish or extravagant meals may raise red flags.

Track Expenses in Real-Time: Use accounting software or apps that allow you to categorize and track meals and entertainment consistently throughout the year.

While meals and entertainment can be valuable tools for building relationships and team culture, it’s essential to follow IRS guidelines to avoid issues down the line. When in doubt, consult with your tax professional to ensure your deductions are legitimate and properly documented.

Working with a knowledgeable CPA firm can make managing meals and entertainment expenses much easier and more effective. From ensuring compliance with IRS rules to identifying every eligible deduction, expert support helps you stay organized, minimize tax liability, and keep your focus on running and growing your business.

Comments